F&O Calculator: Meaning, Usage & More!

What is a Margin Calculator?

To start trading in futures and options, one needs to deposit an initial margin with the broker. This initial margin is calculated by using a software called SPAN- standard portfolio analysis of risk. This margin calculator uses a complex algorithm to determine margins. SPAN margins are revised 6 times a day and hence the value varies according to the time of the day. Margin calculators in simple terms are computational tools used to determine the marginal requirements of the trade.

Not just that, now the traders can also see the expiry-wise P&L statement every month at their ease, tap here to know more about it.

Need for Margin Calculator

Margin calculators are extremely important and essential as it helps in determining the amount one needs to deposit with the broker. Margin calculators take into consideration factors like the risk-taking capacity of the broking house, the balance available in the trading account, and the scrip’s stock price, making it furthermore reliable for the calculation of margin.

How to use the 5paisa Margin Calculator?

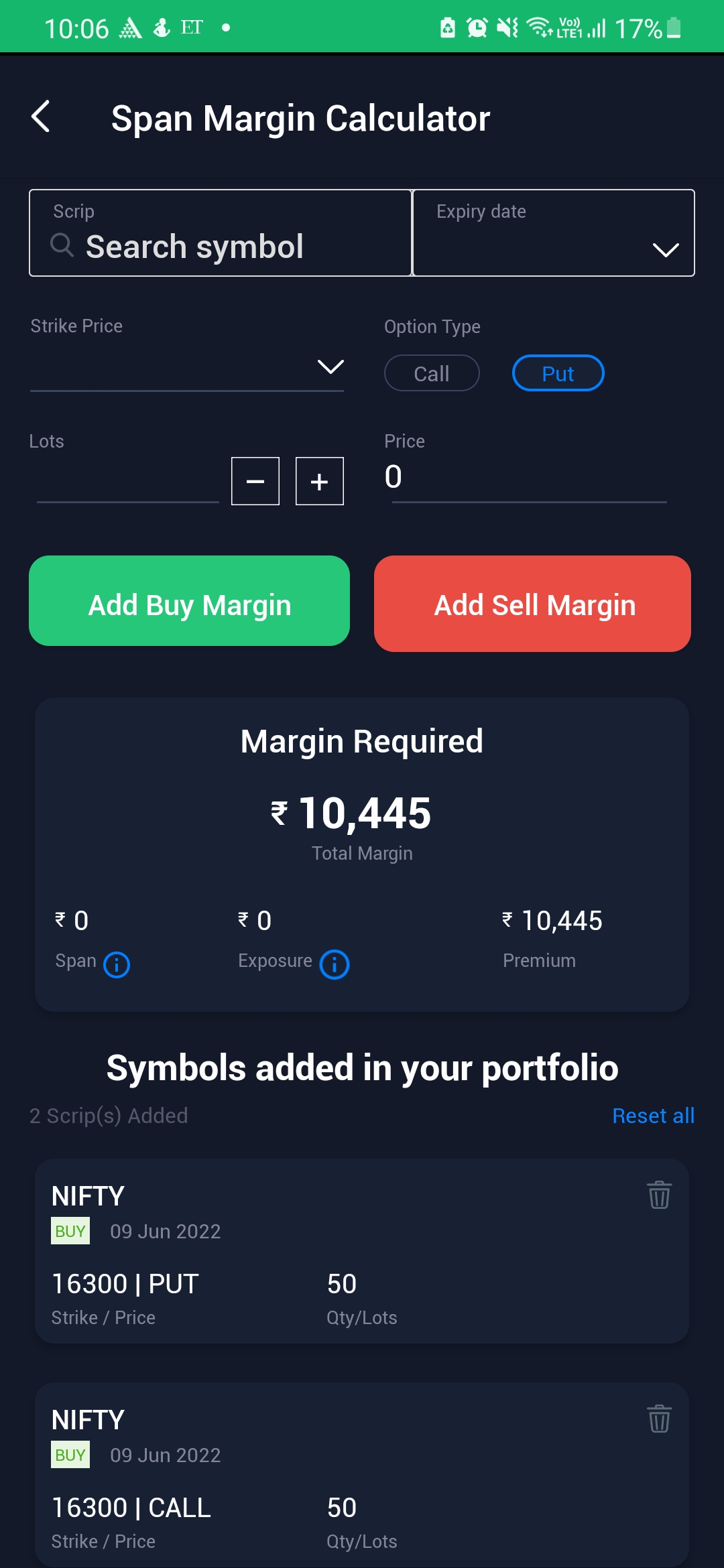

5paisa margin calculator is a simplified tool and can be used as follows:

- Select the exchange

- Choose either Futures or Options

- Choose the ticker symbol

- Select either Put or Call (type of trade)

- Select the expiry date and the strike price

- Enter the lot size of the trade and calculate

How does a Margin Calculator work?

Based on the requirements, there are various margin calculators available like the NSE F&O margin calculator, equity margin calculator, SPAN margin calculator, and options margin calculator. All the calculators use complex algorithms to determine margins. The NSE F&O margin calculator estimates the probability of loss in value of an asset based on a statistical analysis of price trends and volatility whereas SPAN calculates the highest loss in the portfolio under several scenarios. Equity margin is calculated by subtracting the money borrowed from the broker and the value of any in-the-money covered call options sold. To have the efficient margins of F&O, it is suggested to take the recommendations of the derivative advisory team. Know more from here.

Advantages of Margin Calculator

Margin calculators help traders compute the margin required to initiate a trade. This also serves as a good way to estimate the amount involved in purchasing securities, thus helping in outlining the financial map. Calculating the margin beforehand also helps in understanding if the amount in margin amount is sufficient enough to go ahead with the buying of a margin. Margin calculator helps in carrying out transparent transactions with the concerned broker.

To Activate the F&O segment, click here.

Topic Participants

Roopsi Gupta